Today, the first Bitcoin spot ETF applications were approved in the United States. This marks a historic event for cryptocurrencies, eagerly anticipated for several years.

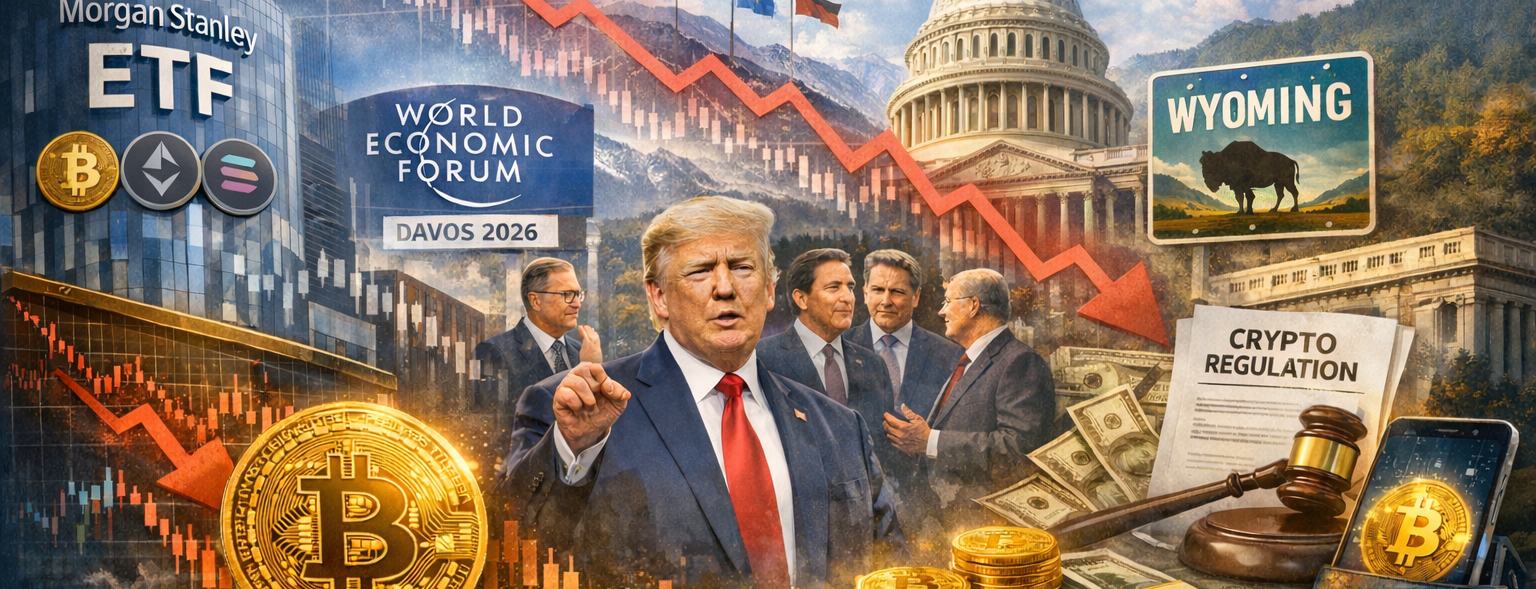

Today, the first Bitcoin spot ETF applications were approved in the United States. An ETF refers to an exchange-traded fund, while a spot ETF specifically refers to an ETF that is backed by the underlying asset, in this case, bitcoins. This marks a historic event for cryptocurrencies, eagerly anticipated for several years.

The U.S. Securities and Exchange Commission (SEC) approved a total of 11 applications today, including applications from BlackRock, the world's largest asset manager, among others. Trading for the approved ETFs will commence tomorrow as U.S. markets open. The combined trading volume of these ETFs is expected to reach billions of euros within the first few days.

Cryptocurrency experts believe that ETFs will make Bitcoin more accessible to a broader audience than ever before. However, the most significant impact of ETFs is likely to ease the entry of institutional players into the cryptocurrency market. Institutions can purchase and hold bitcoin through ETF issuers and their partners. In addition to the approval of ETFs, cryptocurrency experts anticipate that the upcoming months will see a more eased monetary policy from central banks and that the Bitcoin block reward halving scheduled for April will positively influence the entire cryptocurrency market in the near term.

Ville Viitaharju

Cryptocurrency specialist

Last updated: 10.01.2024 22:58